In most cases, it's surprisingly easy to start a new business in Virginia. However, starting a business in a way that offers you strong legal protections in the event something goes wrong can be a bit harder.

For this reason, small business owners will sometimes rely on the services of an attorney when planning out a new business venture.

The problem, however, is that most people underestimate how much a lawyer can help in the weeks and months leading up to their grand opening, meaning many miss out on the valuable services an attorney can provide to help jumpstart their business.

Further, they think of an attorney as simply an additional expense rather than a useful resource to draw from.

While it's certainly not necessary to hire an attorney, the benefits of at least speaking with an attorney will almost always outweigh the costs of an initial consultation.

In this article we'll discuss 11 common, practical ways that an attorney can help you start a small business in Virginia.

However, keep in mind that his is far from a comprehensive list of every service an attorney might offer.

As the best piece of advice anyone can give to a new business owner, you should always speak with an experienced professional if you have any questions or concerns about how to safely and legally bring your plan to life.

After all, the best time to hire an attorney is before you need one.

Contents:

Do I Really Need to Hire an Attorney?

A basic decision-making flow-chart for when you start your business.

Not all small business owners need to hire an attorney to stay protected.

Some may be able to get by with just the information found on Virginia's Business One Stop and other online resources.

However, even if you're confident in your entrepreneurial skills, your first step should still be to at least consider the pros and cons of hiring a lawyer to help you along the way.

You should examine what your business actually needs, and, if you feel you would benefit from hiring an attorney, plan out to what extent you should rely on their aid.

For example, if you're just operating as a sole proprietorship and selling jam at your local farmer's market, you probably don't need to speak with an attorney about your business.

However, if you want to expand your business across state lines (such as if you're selling products or services online), or if you want to form an LLC to protect yourself from personal liability, you may want to discuss your options with an attorney before you file any of the paperwork.

Put simply, the complexity of your business is directly proportional to your need for an attorney.

As your business grows you will take on an increasingly serious risk of legal and financial liability.

For this reason, it's usually wise to consult with an attorney before such problems appear, as hiring an attorney after you notice a problem will often be too little too late.

Discuss a Fee Arrangement that Fits Your Budget

As a small business owner on a budget, your first and most important question is most likely "how much will it cost?"

In general, the only answer is that you'll get what you pay for.

Most attorneys, for example, will bill either hourly or on a flat-fee basis.

So, an attorney may bill you a specific-predetermined amount based on the service rendered (i.e. "it costs $x,xxx to do this service from start to finish").

Or, in more complicated situations, they may bill you based on the amount of work they put into the case (i.e. "I spent this many hours working on your case at a billable rate of $xxx per hour").

Sometimes, a firm or attorney may offer a retainer agreement to clients who need ongoing assistance.

The main benefit of a retainer agreement is that you can proactively address issues before they start to have an effect on your business.

No matter what fee structure you decide on, the point is that you need to find something that works for your specific needs and budget.

Know When It's Time to Do It Yourself A screenshot from the Virginia Business One Stop homepage. This government-run website offers a variety of free resources to help new business owners get their ventures off the ground.

A screenshot from the Virginia Business One Stop homepage. This government-run website offers a variety of free resources to help new business owners get their ventures off the ground.

As a general rule, it's never a bad idea to speak with an attorney. It's just that some business registration tasks are simple enough that you may not need their services.

For example, you should be able to resolve all of the following issues without the assistance of an attorney:

- Writing a business plan / making cashflow estimates.

- Picking out a name for your business.

- Applying for a small business license.

- Applying for an employer identification number (EIN).

- Hiring employees and setting up payroll.

Now, should you talk to an attorney about some of these issues if you're confused? Probably.

Should you mention these things to your attorney if you've already hired them for another matter or service? Most definitely.

Do you want to pay for a consultation about an issue that's outlined on the Virginia Business One Stop website? It's really up to you.

However, as we discussed above, the more complex your situation is, the more likely it is that you'll need an attorney at some point in the process.

Remember, starting your own business is an exercise in managing risk.

Only you can make the final decision on whether the risks of doing it yourself are worth the money you'll save in the short-term.

How an Attorney Can Help You Start a New Business

Attorneys offer a variety of services that can help you set your business up in a way that limits your personal liability in the event of a lawsuit or other unwanted event.

One of the primary benefits of hiring an attorney is that they've most likely helped hundreds of business owners over the years, and will have a great deal of experience in the dos and don'ts of the Virginia business incorporation process.

In this way, they will be knowledgeable about many tips and tricks that can help you start your business off on the right foot.

Most importantly, they can help you avoid common pitfalls that might otherwise complicate your registration process.

In the sections below we'll outline a few ways that an attorney can help you start a new business. However, please keep in mind that this is far from an exhaustive list.

Business attorneys offer many services, and the ones we list below are just a few common topics that might help you register a new business in the Commonwealth.

1. Navigate Legal Structure Decisions: The Basics of Business Formation and Conversion in Virginia Most new Virginia businesses choose to form limited liability companies (LLCs) due to the variety of liability and tax benefits provided by this structure.

Most new Virginia businesses choose to form limited liability companies (LLCs) due to the variety of liability and tax benefits provided by this structure.

If you want to start a new business in Virginia you'll have to choose a specific legal structure to operate under.

The default legal structure in Virginia is a sole proprietorship (or, if the business has multiple owners, a partnership).

Generally speaking, your business automatically becomes a sole proprietorship the moment you make your first sale, meaning that you must follow all relevant rules governing such businesses.

However, sole proprietorships are generally frowned upon in the business world because of the liability and tax problems they tend to create.

For this reason, many small business owners choose to either start their business as a limited liability company (LLC), or convert their sole proprietorship into an LLC once it reaches a certain size.

Similarly, small business attorneys are a useful resource for business owners who want to organize their brand under a certain legal structure.

At a bare minimum an attorney can help educate you about the benefits and risks of each different small business structure.

2. Fulfill Virginia's Business Registration Requirements A sample screenshot of the Articles of Organization form used by the Virginia State Corporation Commission.

A sample screenshot of the Articles of Organization form used by the Virginia State Corporation Commission.

Once you decide on a legal structure for your business, the next step is to make sure your business qualifies for that business type.

For example, every new business owner should check the SCC website to make sure their business name is available.

Similarly, legal structures such as LLCs and S-Corporations have certain requirements that applicants must meet before filing.

While meeting these requirements may seem simple at first, it's still often wise to double check your work with an attorney before you submit the final paperwork.

A missed step or incorrectly marked box could delay your registration by weeks or months, and an attorney can advise you on common pitfalls you may otherwise experience in the process.

As an example of what to expect, Virginia LLCs must meet all of the following requirements in order to do business in the Commonwealth:

- Your business name must be distinguishable from the names of other businesses in Virginia (i.e. no two LLCs can share a name).

- Your business name must include the words "Limited Liability Company," "LLC," or one of the other variations noted by the SCC.

- You must appoint a registered agent and name a registered office.

- You must file your Articles of Organization with the Virginia SCC and pay a small filing fee.

- Your business must remain compliant with all federal, state, and local laws. For example, you'll need to obtain an IRS Employer Identification Number (EIN), as well as a business license for your local area.

- You must pay an annual business registration fee.

Each legal structure has a different list of requirements.

Further, as you might expect, more complicated legal structures include specific, nuanced requirements that you should most likely speak with an attorney about.

Remember, the scale and complexity of your business is directly proportional to your need for an attorney.

Even for basic, vanilla LLCs, it may still be wise to at least consult with an attorney if you have any questions about the application process.

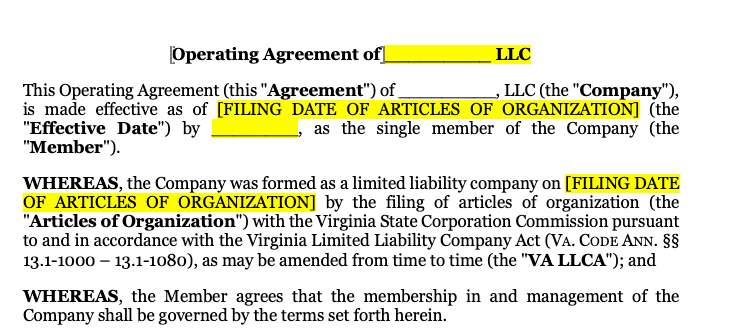

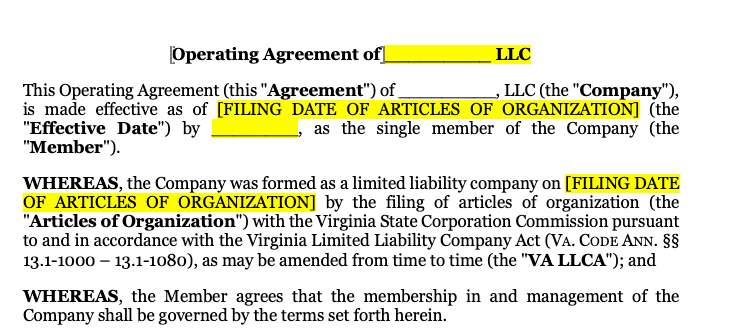

3. Draft an Operating Agreement A sample introduction to a single-member LLC operating agreement for a business in Virginia. We provide this form, and many more, to business owners who hire our firm for their incorporation needs.

A sample introduction to a single-member LLC operating agreement for a business in Virginia. We provide this form, and many more, to business owners who hire our firm for their incorporation needs.

Operating agreements are not a requirement for LLCs registered in Virginia.

However, it's still highly recommended that you create one (or a comparable document if you're filing for a different legal structure).

Put simply, an operating agreement is an internal document that outlines how you will run your business.

For example, if you jointly own an LLC with a partner, who is in charge of managing the business?

Who takes care of payroll?

How much time should each partner invest in the company, and how much interest does each partner hold in the company?

It's important to work out the details of your operating agreement early on, as this document will act as the foundation for most of your subsequent business decisions.

Often, it's smart to talk over your operating agreement plans with an attorney before you sign the document.

While you may not need help with drafting the document, it's still wise to have an attorney look it over before you put your pen to the paper, as the terms of this agreement will greatly affect how you run your business.

4. Apply for a Virginia Small Business License A screenshot of Richmond's small business license application form for 2020. You can find this form on the Richmond, Virginia Department of Finance's forms page.

A screenshot of Richmond's small business license application form for 2020. You can find this form on the Richmond, Virginia Department of Finance's forms page.

A small business license is a bit of a misnomer for the various permits, licenses, and other certifications you need to collect in order to legally operate a business in a specific city or region of Virginia.

While you can choose from any number of legal structures for your business (or simply not register at all), every small business in Virginia must apply for and receive a license to operate in their local city or county.

In fact, one of the most useful services that a small business attorney can offer is knowledge about all local and state laws that may apply to your business.

While applying for a small business license is conceptually rather easy, it can be hard to find the specific laws and regulations that apply to businesses in your local area.

For example, Richmond has several regulations for how food establishments can operate in the city.

While resources such as Municode can be invaluable in helping you learn about all relevant state and local laws, it's still often wise to speak with a local attorney if you have any questions about the process.

Attorneys generally know more about which levers to pull in your local area, and can often make the entire small business license process much easier.

5. Ensure Business Compliance Screenshot taken from https://library.municode.com/va/richmond/codes/code_of_ordinances for the search term “barber.”

Screenshot taken from https://library.municode.com/va/richmond/codes/code_of_ordinances for the search term “barber.”

All Virginia businesses have to comply with various local, state, and federal rules.

Many businesses meet these requirements as a part of starting their business (usually so they can get a small business license, as described above), but staying compliant is another matter entirely.

For this reason, many small business owners will periodically speak with an attorney to ensure their business remains compliant with all relevant laws.

Zoning regulations, tax changes, hiring rules, minimum wage requirements, liability protections, online data privacy policies, and more can all change from year to year, so you'll want to remain ahead of the curve.

Remember, the whole point of speaking with a small business attorney is to keep yourself out of legal trouble.

Especially for businesses that are growing quickly, a little bit of guidance can go a long way towards ensuring success in the future.

Only an attorney familiar with your local area can help you remain compliant with an ever-changing body of law.

How an Attorney Can Help You Grow a New Business

Growing a new business can be hard. For this reason, it's wise to speak with an attorney about how you can grow safely.

As we mentioned earlier in this article, starting a new business in Virginia isn't that hard.

However, growing your business, and keeping yourself out of legal trouble, is another task entirely.

One of the major benefits of hiring a lawyer is that they can help you set your business up for success in a way that limits your personal liability should something go wrong.

Put another way, a lawyer can help limit the amount of risk you incur when you start a new business, and can help you grow that business in a safe and organized manner.

6. Limit Your Personal Liability

Each of the legal structures we discussed above carries different liability protections in the event something goes wrong with your business.

In a sole proprietorship, for instance, your money and the business's money are in the same "pot."

You don't have to keep separate bank accounts, and your money is taxed alongside the company's money.

However, from a legal best practices standpoint, operating as a sole proprietorship is almost always a bad idea for anyone doing more than selling jam at the local farmers market.

Since you and your business are joined in a sole proprietorship, you are personally responsible for all the company's debts, liabilities, and legal issues.

Put another way, if the business goes under, so do you.

As we noted above, the solution for many business owners is to form a limited liability company (LLC), but the protections offered by this legal structure can only go so far.

After all, an LLC is a tool, not an end-all-be-all solution to your liability problems.

An experienced business attorney can offer you additional guidance for limiting your personal liability in the event something goes wrong with your business.

7. Protect Your Business from Future Litigation

In a similar fashion, an attorney can help protect your business from future litigation by directing you towards business best practices and warning you about common legal problems.

While many people feel that retaining a small business attorney is an unnecessary expense, speaking with an attorney after you're already in a lawsuit is often too late.

A good lawyer can help you identify problems early on, and can provide actionable steps to help you avoid legal action in the future.

One of the best actions you can take when growing your business is building a working relationship with a local attorney.

If you're ever uncomfortable about a legal situation just give them a call for a quick consultation.

Better yet, look into local legal retainer services that can provide you with guidance on minor issues, such as document review and potential liability issues.

Regardless of the path you take, it's always a good idea to protect your business from future litigation.

The fact of the matter is simply that this is easier to do when you have an attorney in your contacts list.

8. Register Your Branding Materials as Federal Trademarks

We've discussed the pros, cons, and how-tos of trademark registration at length in other articles on our blog, to the point where we just went ahead and wrote a (bestselling!) book about the subject.

For this reason, we'll try to be a short as possible here, and simply link you to several of our more in-depth resources on the subject.

As a quick reading list on federal trademark laws, check out:

- United States Trademark Law: The Ultimate Guide

- Trademark Class Basics: An Introduction to the 45 International Trademark Classes

- How to Perform a Trademark Search in Three Steps

- How to Start a Business in Virginia: A 10-Step Guide

For the purposes of this article, the only thing you need to know is that trademark registration is an essential tool for any business seeking to sell products and services online or outside their own state.

Further, registering your first trademark is relatively easy, though you'll have to pay a few hundred dollars for the U.S. Patent and Trademark Office (USPTO) to process your application.

If you plan on expanding your brand outside your local area in the near future, you should at least discuss the various costs and benefits of trademark registration with an attorney.

Otherwise, you may accidentally infringe on another brand's mark, or otherwise cause intellectual property problems down the line.

Additional Services to Consider

Attorneys offer more than just registration and consulting services. You can also ask them to review your contracts, open new businesses in other states, and even work with you on issues such as hiring and firing.

Finally, many attorneys offer several additional services that can help you safely grow your brand in the long-term.

Generally, these services relate to the various ways you can protect yourself (and your business) from potential legal problems in the future.

For example, an attorney can help you draft and update a full terms of service for your website, and can help you understand the ins and outs of current privacy legislation.

Similarly, they can help you set up in-house processes for safely scaling your growth, and can act as an insurance measure in the event you have to deal with a potentially volatile situation (such as if you have to hire a problematic employee).

9. Draft Your Terms of Service and Other Similar Contracts

All modern websites include both a terms of service page and a privacy policy.

However, you should be especially careful with how you create these documents, as their contents can greatly affect your liability in future litigation.

For example, if your privacy policy includes language concerning website user data, and you accidentally leak this data or use it in an unethical way, the language in the privacy policy will dictate what happens in the resulting civil case.

Generally speaking, many small business owners will rework online templates to fit their business model.

However, you should be especially careful with how you use legal templates or other downloads you find online.

Often, your terms of service and privacy policy will have to be tailored to how you specifically use the data and information you gain from your website.

A general template cannot fully account for all of the variables involved in this process.

The same is somewhat true for online services that offer custom-tailored legal documents or document review from attorneys.

Put another way, do you want to trust the safety of your business to a free or cheap online download?

If not, then you should at least have a local business attorney look over the documents to ensure they're compliant with all federal, state, and local laws.

The same is true for other contracts as well, such as employment contracts, freelancer agreements, and pretty much anything else you need to draft for your new business.

10. Safely Scale Your Business for Future Growth

Like most things, businesses grow more complex over time as you continually add more services, products, and people to the mix.

Depending on the scope, range, and size of your business, safely scaling your business to meet the needs of your future clients can be a complex endeavor.

For example, the documents and legal structure you use in one state may not transfer well to a business in another.

Similarly, the liabilities you take on as the owner can change over time as your company begins to serve more people and bring in more revenue.

A small business attorney can help ensure that your business remains compliant wherever you go, and can give you the peace of mind that you're remaining in step with all relevant federal, state, and local laws.

11. Talk about Hiring, Firing, and Other Potential Liabilities

As the final and possibly most helpful service, attorneys can also act as useful resources in cases where you just need to talk about potential legal issues.

If you ever have a question about an aspect of your business (such as your hiring or firing practices), or if you need to deal with any other potential liabilities, an attorney can help keep you in check while also limiting the liability you take on in these processes.

Simply having someone to talk to is an often-overlooked benefit of having a lawyer on your side, and is certainly a resource you should take advantage of as you grow your new Virginia business.

Conclusion

Attorneys are a useful tool you can leverage to start your business off on the right foot.

It's fairly easy to start a new business in Virginia, but growing that business can be a bit more complicated.

Put simply, the more complex your business is, the more likely is is that you would benefit from hiring an attorney.

Speaking with a lawyer before you submit any documents or being work as a small business can help protect you from future litigation.

Further, attorneys often offer a variety of services that can help you safely grow your business in the future without taking on additional liability.

Most importantly, hiring an attorney can help give you additional peace of mind, as you'll know that the safety of your business is in good hands.

Even if you don't feel that you need much help to begin with, the support and assurance you can get from an experienced business lawyer can be crucial to your future success.

A sample introduction to a single-member LLC operating agreement for a business in Virginia. We provide this form, and many more, to business owners who hire our firm for their incorporation needs.

A sample introduction to a single-member LLC operating agreement for a business in Virginia. We provide this form, and many more, to business owners who hire our firm for their incorporation needs.